Responsible banking

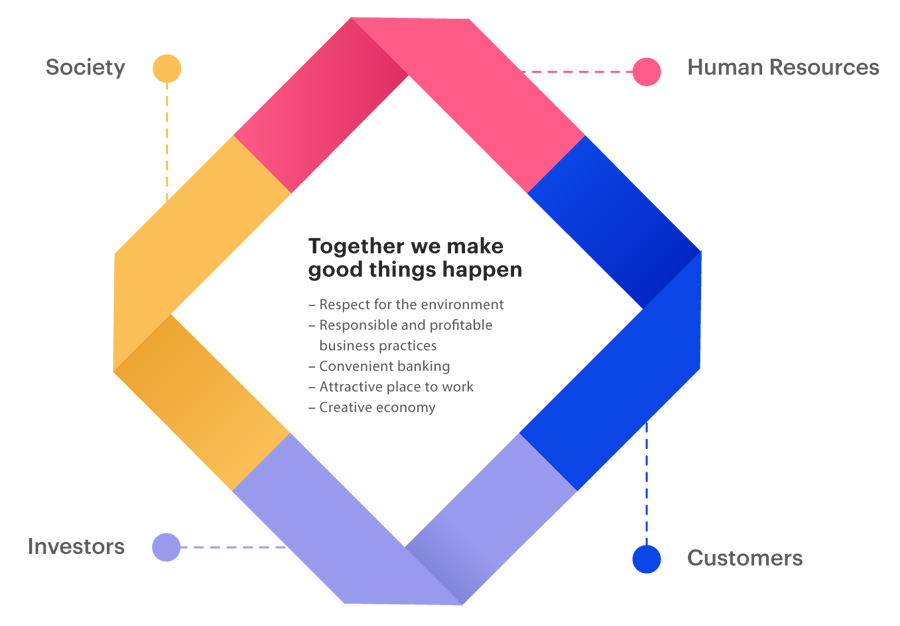

At Arion Bank we provide services to homes, companies and investors and strive to meet the needs of customers requiring a broad spectrum of financial services. Arion Bank occupies a strong position on its markets owing to its efficiency and diversity of products and services. The Bank’s core strategy is to excel by offering smart and reliable financial solutions which create future value for our customers, shareholders and society as a whole. Arion Bank’s sustainability policy bears the title Together we make good things happen and signifies that the Bank wants to act as a role model in responsible and profitable business practices, taking into account the environment and society.

We refer to Arion Bank’s values as cornerstones and they are designed to provide guidance when making decisions and in everything the employees do. The cornerstones address our role, mentality and conduct and they are: We find solutions, we make a difference, we get things done, and we say what we mean. The Bank’s code of conduct has been approved by the Board of Directors and is designed to support responsible decision making.

Sustainability policy

We want to act as a role model by promoting responsible and profitable business practices, which take into account the environment, the economy and the society in which we live and work. We try to see things from our customers’ viewpoint and strive to do better today than we did yesterday.

We work in an attractive workplace where knowledge creates future value for the benefit of our customers, investors and society as a whole.

The diagram below shows our main focuses in sustainability.

Sustainability reporting

At Arion Bank we aim to ensure that sustainability is part of the Bank's day-to-day activities, its decision-making and processes. For the third time information on sustainability has been prepared in accordance with the Global Reporting Initiative standard, GRI Core, which helps companies and institutions share information on sustainability in a transparent and comparable way. When sharing information on non-financial factors of the business the ESG reporting guide for the Nasdaq Nordic and the 10 Principles of the UN Global Compact are also used a reference. The UN Sustainable Development Goals are also referred to. For the first time we report on the progress made in implementing the UN Principles for Responsible Banking to which Arion Bank became a signatory in September 2019.

Deloitte has provided an opinion with limited assurance on non-financial reporting by Arion Bank in 2020 which is presented in accordance with the Global Reporting Initiative (GRI) and the Nasdaq ESG Reporting Guide.

Responsible banking in the time of a pandemic

COVID-19 had a profound impact on the Bank and like everyone else it needed to adapt to the new circumstances rapidly as public health measures were introduced and restrictions on mass gatherings and social distancing were brought in. The Bank has made every effort to find ways to continue to brings its customers quality service, while at the same time acting responsibly with the respect to public health measures and finding solutions to mitigate the financial impact of the pandemic.

The pandemic meant that branches were only open to people with appointments for much of the year. As a result there was a huge drop in the number of visits, while service channels, such as telephone, e-mail and webchat saw a 110% increase in use. Remote services were further developed and at the beginning of the year Arion Bank began offering video meetings via Teams where customers can obtain the advice and services they want anywhere, anytime. The Bank’s focus on developing digital service channels in recent years has proved invaluable and there was a surge in use over the year. An ever growing number of customers are using online banking or the app to do business.

From the very outset of the pandemic we did our utmost to look after our employees, guarantee their safety and well-being during these extraordinary times. Most people started working from home and spent a large part of the year doing so. Video meetings were held to share necessary information and to ensure effective teamwork. Working from home has brought our teams from inside and outside the Reykjavík area closer together due to the frequent contact via video meetings and other media. Events and training and education for employees and customers were mainly held in digital format this year to great effect.

From the very outset of the pandemic we did our outmost to look after our employees, guarantee their safety and well-being during these extraordinary times. Most people started working from home and spent a large part of the year doing so. Video meetings were held to share necessary information and to ensure effective teamwork.

Arion Bank did its utmost to help customers who were feeling the financial impact of COVID-19. Customers suffering a sudden drop in income were given the option of a mortgage payment holiday of up to 9 months and Arion Bank was the first bank in Iceland to make this service available. Loan deferrals peaked in April and May when loans to approximately 2,000 individuals and 500 companies were subject to payment holidays. The government and the banks reached an agreement on providing business support loans and supplementary loans to bridge the financial gap. More than 300 business support loans were provided and 86% of these were processed automatically.

Arion Bank is optimistic about the way ahead after a year which was both challenging and instructive. One of the key lessons from 2020 is that people can work very effectively from home. We have set goals to stimulate more productivity and further enhance teamwork.

Responsible lending, deposits and investment

How a bank manages its financial resources can have a decisive impact on the progress of sustainable development in individual countries and globally. This is why Arion Bank endeavours to continuously perform better in its operations and to have a positive impact on both the environment and society.

In 2018 the Bank’s credit rules were updated to include provisions incorporating environmental, social and governance factors when evaluating loans. In September 2019 the Bank became a signatory to the United Nations Principles for Responsible Banking (PRB). These principles, presented at the start of the UN General Assembly, align banking with international goals and commitments such as the UN Sustainable Development Goals and the Paris Climate Agreement. Arion Bank was one of the first banks to announce its support for the principles, with 130 banks from 49 countries signing up.

Subsequently, in December 2019, the Board of Directors of Arion Bank approved a new and ambitious environment and climate policy and targets which align with these commitments. One of the aims of the new policy is for the Bank to focus its attention on financing projects on sustainable development and green infrastructure. One of the tasks in 2020 was to implement the principles of responsible banking and the objectives of the environment and climate policy. The Bank’s loan portfolio was analyzed according to green criteria and work began on creating a financing framework for the green product range, deposits and loans, which is also envisaged as a foundation for possible green bond issues. The Bank’s credit policy was also updated in 2020 with a special emphasis on sustainability.

One of the tasks in 2020 was to implement the principles of responsible banking and the objectives of the environment and climate policy. The Bank’s loan portfolio was analyzed according to green criteria and work began on creating a financing framework for the green product range, deposits and loans, which is also envisaged as a foundation for possible green bond issues.

One of the fundamental roles of banks is to facilitate the flow of funds from savers to borrowers, and deposits are central to this function. In mid-2020 Arion Bank became the first Icelandic bank to introduce a green deposit account called Green Deposits. Green Deposits is a new deposit account designed for individuals, NGOs and companies wanting to contribute towards a greener future. Money deposited into Green Deposits is invested in green projects in line with Arion Bank's framework on green deposits.

Initially the funds in Green Deposits were exclusively used to finance green car loans which support the transition to green energy, and Arion Bank customers do not pay any loan origination fees for financing cars which run entirely on electricity or other 100% renewables. The popularity of the account meant that it proved necessary to expand the deposit framework at the end of the year and by then the Bank’s customers had invested ISK 5 billion in Green Deposits. New projects included ones involving the circular economy, emission controls and more effective waste management. By putting savings into a Green Deposits account our customers are supporting the UN Sustainable Development Goals 7, 9, 11, 12 and 13.

In the autumn of 2020, Arion Bank became the first bank in Iceland to offer better mortgage rates to customers buying environmentally certified housing. The amount of environmentally certified housing is very limited in Iceland but by launching this product the Bank aims to encourage the growth of green certification and to help its customers, building contractors and real estate companies to move in this direction.

The Asset Management division and the Bank’s subsidiary Stefnir had ISK 1,131 billion in assets under management at the end of 2020. During the year Institutional Asset Management introduced rules of procedure on responsible investment which incorporate the three basic criteria of sustainability: environmental, social and governance (ESG). Institutional Asset Management is a signatory to the United Nations Principles for Responsible Investment (PRI) and has published progress reports since 2019. Therefore not only financial criteria, but also other relevant criteria, are taken into account when analyzing investments and developing clients’ asset portfolios. See the section on Responsible Investment on the Bank’s website and the section on Markets for more details.

Every effort counts

ESG risk assessment

Arion Bank conducted a risk assessment at the beginning of 2021 on factors relating to sustainability in order to get a structured view of risk factors. The assessment addresses environmental, social and governance factors (ESG). Specialists from the Bank held three workshops at which each factor was evaluated and the risks assessed. When assessing the risks every effort was made to ignore the impact of COVID-19 and to instead focus on a normal situation.

The assessment identified 49 ESG-related risks which were fairly evenly divided between the three factors. An assessment was made of the likelihood of an event linked to risk factors occurring and its possible impact on Arion Bank. The vast majority of risks are evaluated as low or medium level for the Bank when management of risk factors is factored in, while one risk was placed in the take action category. Actions were then examined which will then reduce the likelihood of risks occurring and minimize their impact on the business and operations.

Task Force on Climate-related Financial Disclosures (TCFD)

In order to gain a better overview of the risk related to climate change the Bank has made use of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) whose role is to make proposals on and to increase transparency around the financial impact of climate change. TCFD has defined the industries which are likely to feel the greatest impact from climate change over the coming decades and the risk is divided into transitional risk and physical risk. An example of transitional risk is the transition to green energy in the fishing industry, and an example of a physical risk is more volatile weather conditions which could result in serious natural disasters. Climate change-related risks span many decades and are therefore dissimilar to many other risks in the Bank’s loan portfolio.

The table below displays the Bank’s loans to sectors which are defined as important for tackling climate change according to the recommendations of TCFD. Given Iceland’s unique position with regard to its geographical location and sources of energy, the Bank has adapted the industry categories to the situation in Iceland and has made use of the National Inventory Report of the Environment Agency of Iceland which describes the total emissions of greenhouse gases in Iceland. The results of the TCFD analysis are used in the Bank’s internal assessment of capital requirements for climate change.

Arion Bank will continue to implement TCFD in 2021.

TCFD material groups | TCFD sector | Both transition and physical risk | Mainly Transition risk | Mainly Physical risk |

|---|---|---|---|---|

Financial Group | Asset owners and asset managers | 0 | 5.092 | 0 |

Financial Group | Credit Institutions | 0 | 39.327 | 0 |

Financial Group | Insurance Companies | 0 | 21 | 0 |

Energy | Energy | 0 | 0 | 0 |

Agriculture, Food and Forest products Group | Agriculture | 2.513 | 0 | 0 |

Agriculture, Food and Forest products Group | Beverages, Packed food and Meats | 0 | 28.035 | 0 |

Agriculture, Food and Forest products Group | Fishing* | 79.464 | 0 | 12.351 |

Agriculture, Food and Forest products Group | Forestry | 546 | 0 | 0 |

Agriculture, Food and Forest products Group | Wholesale* | 0 | 9.287 | 0 |

Transportation | Air transport | 0 | 7.554 | 0 |

Transportation | Automobiles and components | 0 | 5.707 | 0 |

Transportation | Shipping | 0 | 4.652 | 0 |

Transportation | Trucks, buses and working machines | 0 | 2.716 | 0 |

Materials and Buildings Group | Capital Goods | 0 | 550 | 0 |

Materials and Buildings Group | Construction | 0 | 47.812 | 0 |

Materials and Buildings Group | Construction materials (excl wood) | 0 | 3.479 | 0 |

Materials and Buildings Group | Metals & Mining | 0 | 1.301 | 0 |

Other Real Estates* | Hotels** | 0 | 29.413 | 0 |

Other Real Estates* | Real Estate Companies*** | 0 | 0 | 7.897 |

Other Real Estates* | Residential Reste estate*** | 0 | 0 | 35.019 |

Other tourism* | Other tourism* | 0 | 7.610 | 0 |

Total ISK m. | 85.523 | 192.557 | 55.268 |

* Not part of original TCFD but added due to importance in Iceland

** Hotels added separately

*** 10% of exposure due to physical risk (e.g.; sea level rise, etc.)

Arion Bank’s ESG rating and commitment to sustainability

Arion Bank achieved outstanding score in Reitun’s ESG rating

In 2020 Arion Bank achieved an outstanding score in Reitun’s ESG rating, scoring 86 out of 100 possible points and placing it in category A3. Approximately 30 Icelandic issuers have been rated by Reitun and the average score is 60 points.

The rating takes into account the fact that the integration of ESG factors into a bank’s investment and lending activities is a major risk factor and that Arion Bank has shown an innovative approach in this area by developing a methodology to evaluate investment options, primarily listed companies, with respect to ESG and has thus used its influential position to positive effect. Reitun also took into consideration the fact that Arion Bank offers better lending rates for investments in eco-friendly vehicles and was the first bank in Iceland to offer a green deposit account. The rating also notes that information security is a major risk factor in financial services and Arion Bank manages these risks effectively. Human resources at the Bank are also well managed and environmental issues within the Bank are handled responsibly.

Further information on the results of the ESG rating can be found here.

UNEP FI and Principles for Responsible Banking - PRB

In July 2019 Arion Bank became a signatory to UNEP FI, United Nations Environment Programme Finance Initiative which is a partnership between United Nations Environment and more than 250 financial institutions across the world working to understand today’s environmental, social and governance challenges.

In September 2019 Arion Bank became a signatory to the Principles for Responsible Banking (PRI) which were devised by UNEP FI and 30 international banks. Further information on Arion Bank’s involvement with PRB can be found here.

An overview of the progress made by the Bank in implementing the principles at Arion Bank can be seen here.

Forum for climate issues and green solutions – Green by Iceland

In September 2019 Arion Bank became one of the founding members of a joint business and government forum on climate issues and green solutions called Green by Iceland. The role of Green by Iceland is to strengthen the partnership between the business sector and the government in order to reduce greenhouse gas emissions and to bring about carbon neutrality by 2040. The forum will also work with Icelandic companies to market green solutions internationally and to underpin Iceland's reputation as a global sustainability leader.

At the beginning of 2020 the Bank signed up for the challenge Hreinn, 2 og 3! organized by Green by Iceland, where companies are encouraged to make the transition to 100% renewable energy for their vehicles. Under this initiative, the use of new corporate cars powered by fossil fuels will be discontinued by 2023. This will make Iceland a global leader in the use of environmentally friendly fuels. This is in line with our new environment and climate policy which states that no new vehicles will be bought from 2023 unless they run on 100% renewable energy.

United Nations Principles for Responsible Investment – UN PRI

In late 2017 Arion Bank became a signatory to the United Nations Principles for Responsible Investment (UN PRI). The principles are designed to help investors understand the effect of environmental, social and governance (ESG) issues on investment and thereby encourage signatories to the principles to take non-financial factors into account when making investment decisions. The Bank’s Asset Management division has published a progress report on responsible investment since 2019. More information on responsible investments can be found in the Markets section.

UN Global Compact – the UN’s initiative on sustainability

Arion Bank has been a signatory to the UN Global Compact, the UN’s initiative on sustainability, since the end of 2016 and we submit a progress report to the UN every year. The compact sets out 10 principles on human rights, the labour market, the environment and anti-corruption.

IcelandSIF - Iceland Sustainable Investment Forum

Arion Bank has been an active participant in shaping and developing responsible investment in Iceland and has had representatives in the board and working groups in IcelandSIF, Iceland Sustainable Investment Forum. Arion Bank was one of the founder members of the organization in 2017.

Excellence in corporate governance

Arion Bank has been recognized as a company which had achieved excellence in corporate governance following a formal assessment based on guidelines on corporate governance issued by the Icelandic Chamber of Commerce, the Confederation of Icelandic Employers, and Nasdaq Iceland. Arion Bank was first recognized for excellence in corporate governance in 2016. This recognition is given following a comprehensive audit by an independent party of corporate governance at the Bank, such as governance by the Board of Directors, sub-committees and management. It applies for three years. For further information see the sections on Corporate Governance and on Non-financial Information.

Festa – sustainability centre

Arion Bank has been an active partner of Festa, a sustainability centre, for several years. Festa’s role is to add to the expertise on sustainability at companies, institutions and organizations so that they can adopt sustainable business practices.

City of Reykjavík and Festa’s Declaration on Climate Change

In November 2015 Arion Bank became one of 104 signatories to the City of Reykjavík and Festa’s Declaration on Climate Change. One of the main tasks concerning climate change is to map the environmental impact of operations and to systematically reduce the negative effects. We have published the Bank’s environmental accounts annually since 2016. Further information on environment and climate issues at Arion Bank can be found here and the section on Non-financial Information.

Declaration of intent on investment for a sustainable recovery

On 25 September 2020 Arion Bank signed a declaration of intent on investment for a sustainable recovery. The Prime Minister’s Office, Festa – Center for Sustainability, the Icelandic Financial Services Association (SFF) and the National Association of Pension Funds (LL) devised the declaration in close cooperation with representatives of the main participants in the financial market. The declaration of intent conforms to Arion Bank’s policy and goals on greater sustainability. For further information on Arion Bank’s involvement in the declaration see here.

Ministry of Welfare’s equal pay symbol

In the autumn of 2018 Arion Bank was awarded the Ministry of Welfare’s equal pay symbol after having been certified by the standards agency BSI á Íslandi, the first Icelandic bank to gain this recognition. The Bank first gained equal pay certification in 2015 and has since undergone a pay assessment annually. For further information on equal opportunities see the section on Human Resources and on Non-financial information.

UN Women and UN Global Compact

The Bank has supported the UN Women/UN Global Compact Empowerment Principles since 2014. These are international declarations and treaties under the auspices of the United Nations which companies and institutions can use as guidelines when implementing responsible working practices, irrespective of geographic location or sector and primarily concern advancing gender equality. For further information see the sections on equal opportunities at Arion Bank and on Non-financial information.

FKA Equality Balance

In 2020 CEO Benedikt Gíslason signed a declaration of intent on the Equality Balance, stating that over the next few years Arion Bank intends make a focused effort to balance out the gender ratio at senior management level. The Equality Balance is an initiative created by the Association of Icelandic Businesswomen (FKA).

The Bank as also recognized by the Equality Balance for achieving an even gender ratio at the top level of management during the year. See here for further information.

Kolviður – Iceland Carbon Fund

Arion Bank and the Iceland Carbon Fund (ICF) have reached a continuing partnership agreement on offsetting the carbon emissions produced by the Bank's activities and this agreement was renewed to address emissions in 2020. The ICF will fix the carbon in plants and soil through soil reclamation and forestry to offset the carbon emissions resulting from the Bank's activities during the year. The ICF is expected to plant up to 4,700 trees for the operating year 2020. This refers to emissions produced, for example, by vehicles used in the Bank's operations, its business premises, waste, business flights and journeys to work.

GRI – Global Reporting Initiative

Global Reporting Initiative has developed a standard which helps companies and institutions report their progress in environmental, social and economic issues in such a way that it enables a direct comparison of data between companies. For the third time the Bank is presenting information on corporate social responsibility and sustainability in the Bank’s operations in accordance with the GRI Core standard. See Arion Bank’s GRI Index here.

Nasdaq ESG reporting guide

The ESG Reporting Guide for the Nasdaq Nordic exchanges provides guidance on data disclosure and the environmental, social and governance impact of listed companies. Since 2016 Arion Bank has taken these criteria into account when reporting on sustainability. The criteria formally came into effect in 2017 and a second edition of the reporting guide came out in 2019. For further information see the section on Non-financial Information.

UN Sustainable Development Goals

At the beginning of 2020 the executive committee of Arion Bank approved six Sustainable Development Goals which the Bank intends to focus on. These goals are number 5 on gender equality; number 7 on affordable and clean energy; number 8 on decent work and economic growth; number 9 on industry, innovation and infrastructure; number 12 on responsible consumption and production; and number 13 on climate action.

The Bank’s operations, including action on gender equality, our policy and targets on environment and climate issues, support for innovation and the business sector as a whole, state-of-the-art digital services and active participation on the development of the economy closely align with these sustainable development goals.

.jpg)

Steering committee on sustainability

Arion Bank has a steering committee on sustainability. The sustainability project manager is an employee of the CEO’s Office and manages the work carried out by the committee. Members of the steering committee are the managing directors of Markets, Retail Banking and Corporate & Investment Banking as the heads of Corporate Communications and Sales & Marketing.

The main tasks of the committee are strategic planning in the field of sustainability. The person responsible for sustainability at Arion Bank is the CEO.

Suppliers

The Bank's strategy is to create future value for the benefit of its customers, shareholders and society as a whole, and in keeping with this the Bank seeks to source its supplies from local providers as far as possible, provided they meet the requirements on quality and price.

Nearly all of the Bank’s key suppliers operate in Iceland. Although the supply chain does extend overseas, the first link is usually here on the domestic market. In fact there is only one international supplier in the top 10 main suppliers and only 8 in the top 50.

The majority of the Bank’s international suppliers are connected to the buying of software, advisory services and IT services. Hardware is almost entirely acquired from Icelandic suppliers.

Buying is divided between the 50 main suppliers as follows

Meticulous buying process

In 2019 the Bank reviewed the questions in its assessment of suppliers and their commitment to equality, labour laws and environmental and climate issues. A new supplier assessment process was introduced at the beginning of 2020. The suppliers’ commitment to these issues will have an impact in the future on how willing the Bank is to do business with them. The Bank will regularly assess the performance of suppliers with which it has long-term business relationships.

The Bank’s environment and climate policy, approved by the board of directors in December 2019, requires our suppliers to take into account the environmental and climate impact of their activities. Furthermore, when comparing similar offers from suppliers, environmental and climate considerations will be decisive in our decision.

New rules on buying were approved in the autumn of 2020 which took these objectives into account, and in 2020 all the Bank’s largest suppliers with whom the Bank has made outsourcing agreements underwent the suppliers’ assessment. The Bank then began to ask new suppliers about their performance with respect to equality, labour laws and environmental and climate issues.

A code of conduct for suppliers, which focuses on sustainability and social responsibility, was created in 2020 and will be introduced in 2021 and will be an integral part of buying agreements.

A secure financial system – for the benefit of society

Society relies on having an effective and secure financial system, and Arion Bank, along with other financial institutions, plays a key role in ensuring such a system exists in Iceland.

We create our business on the basis of sound organization, skilled employees, robust internal controls and effective and secure systems.

Ensuring secure movements of capital and safeguarding the assets and information entrusted to it are duties the Bank takes very seriously. The Bank is also ever alert to all kinds of financial crimes and takes every precaution to minimize the damage such crimes can have on customers, the Bank's operations and society as a whole.

We prioritize measures to prevent:

- Financial crimes such as money laundering, terrorist financing, fraud, and bribery and corruption

- Conflicts of interest

- Market manipulation and insider misconduct

- Cybercrime

We try to ensure that we do not do business with anyone conducting illegal activities or subject to international sanctions. We place great importance on knowing our customers and others we work with and monitor financial transactions in order to identify transactions which could indicate illegal conduct. The Bank is also vigilant towards cyber-attacks and online scams, which are increasing threats as digital banking gains popularity. See the information for customers on the Bank’s website.

However, no form of monitoring is as effective as an alert and vigilant employee who receives regular training to learn to recognize and respond to suspicious behaviour. Every year employees undergo training to maintain their knowledge, including on measures against financial crime, security issues and the handling of confidential information.

However, no form of monitoring is as effective as an alert and vigilant employee who receives regular training to learn to recognize and respond to suspicious behaviour. Every year employees undergo training to maintain their knowledge, including on measures against financial crime, security issues and the handling of confidential information.

Any suspicions of illegal activities by our customers are reported to the police without exception, and the Bank does its utmost to help the authorities with their enquiries. Arion Bank has also adopted a policy on whistleblowing, whereby employees are encouraged to report any suspicion of inappropriate or illegal activity by the Bank, its employees or partners. The Bank keeps the source of all such tip-offs confidential and protects the identity of anyone coming forward to make their suspicions known. Employees can also make anonymous tip-offs. All reports of potentially illegal conduct are investigated by the Bank's internal control units and referred to the relevant law enforcement authorities as required. Employees and other people are also given the opportunity to send tip-offs directly to the Financial Supervisory Authority.

Internal rules and controls

Arion Bank employees are well aware that the Bank’s activities have an impact on different groups and on society as a whole. We have adopted procedures, a code of ethics and policies on different aspects of operations, including disclosure, data protection, information security, money laundering and equal opportunities.

Rules and terms of business on the Bank’s website

Managing risk and taking informed decisions is a crucial component of the Bank's activities and its responsibility towards society. Risk management is therefore a core activity within the Bank. The Bank’s policy is to have in place an active risk management function which analyzes and measures risk and takes action if it exceeds defined limits. Coinciding with the Annual and Sustainability Report the Bank also publishes Pillar 3 Risk Disclosures which address the main risks and how to manage them.

Further information on internal controls, i.e. risk management, internal audit, compliance and data protection at Arion Bank can be found here.

Corporate governance

Good corporate governance helps to foster open and honest relations between the Board of Directors, shareholders, customers and other stakeholders, such as the Bank's employees and the general public. Corporate governance also lays the foundations to responsible management and decision-making, with the objective of generating lasting value. The Board of Directors places great importance on good corporate governance and re-evaluates its governance practices regularly on the basis of recognized guidelines on corporate governance.

Further information on corporate governance at Arion Bank and the corporate governance statement can be found here.

.png)

.png)