Funding and liquidity

In 2020 the Bank continued to diversify its funding, issuing AT1 instruments and unsecured bonds in euros. The Bank pursues prudent funding and liquidity management strategies which is reflected in the Bank’s strong liquidity ratios and moderate maturities of long-term debt in the medium term.

International bond issues

Arion Bank became the first Icelandic financial institution to issue bonds eligible as Additional Tier 1 capital under the Financial Undertakings Act No. 161/2002 when it issued $100 million bonds in February. The bonds have no fixed maturity date and can be called by Arion Bank in five years. The bonds have a fixed coupon of 6.25% and were sold at a margin of 4.84% over US Treasury bonds. The bond issue was oversubscribed, with orders received from over 90 investors from the UK, Switzerland and Scandinavia with total demand of around $500 million.

In November 2020 Arion Bank issued new 3.5 year senior unsecured bonds for a total of €300 million. The bond offering was oversubscribed, and orders were received from more than 50 investors with total demand around €500 million. The bonds bear a fixed 0.625% coupon and were sold at rates equivalent to a 1.15% margin over interbank rates. At the same time a tender offer took place for €300 million of a €500 million issue maturing in December 2021.

Maturity profile

Combination of total funding

Credit rating

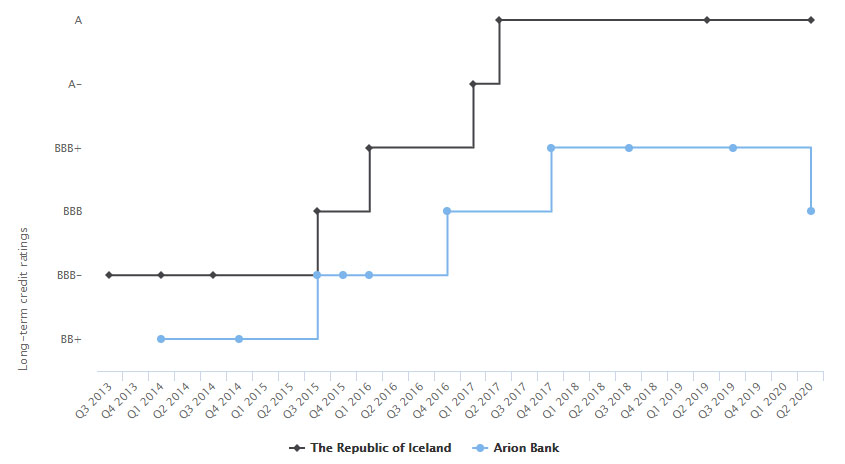

In April Standard & Poor’s downgraded the credit ratings of Arion Bank, Landsbankinn and Íslandsbanki from BBB+ to BBB but upgraded the outlook from negative to stable. The Bank’s short-term rating is A-2.

Standard & Poor's noted that the changed rating reflected the prospect of a substantial economic downturn in 2020 both in Iceland and the rest of Europe. The company went on to say that this downturn would highlight the weaknesses of the Icelandic banking system and result in greater economic risk due to COVID-19.

Standard & Poor's (S&P)

| Category | Arion Bank | The Republic of Iceland* |

|---|---|---|

| Long term | BBB | A |

| Short term | A-2 | A-1 |

| Outlook |

Stable | Stable |

| Last rating action |

24 April 2020 | 15 May 2020 |

*Foreign currency obligations. Please visit www.cb.is for further information.

Credit rating - timeline

Issues of covered bonds and commercial paper

Arion Bank continued to issue covered bonds which are secured in accordance with the Covered Bond Act No. 11/2008. In 2020 the Bank issued covered bonds amounting to ISK 5,060 million.

Arion Bank renewed its agreement with Kvika, Íslandsbanki and Landsbankinn on market making for covered bonds issued by Arion Bank on Nasdaq Iceland. The purpose of the agreement is to stimulate trading with benchmark covered bonds issued by the Bank.

Liquidity and liquidity risk

Arion Bank is largely funded with deposits from individuals, corporations and pension funds. One of Arion Bank's key objectives is to maintain a strong liquidity coverage ratio (LCR) to support the Bank’s strategic direction. The LCR, which is calculated according to rules issued by the Central Bank of Iceland and Basel III Standard addresses risk factors relating to the stickiness of deposits and the maturity mismatch of the assets and liabilities. At the end of 2020 the Bank's LCR was 188% and the ratio for foreign currencies was 449%, well above the minimum requirement stipulated by the Central Bank of Iceland.

The Bank’s net stable funding ratio, NSFR, was 117% at the end of 2020 and 134% in foreign currency. This ratio measures the proportion of Bank’s available stable funding to necessary stable funding according to a method which takes into account the liquidity of assets and the maturity of liabilities. These high ratios underline the Bank’s robust funding and its ability to support the Bank’s lending activities in the future.